Will gas cause rude noises?

A Watcher writes to remind us of a Wanganui Chronicle article published over a year ago (28 July 2005 to be exact) titled, "No sneaky sale of gas utility, Laws promises".

A Watcher writes to remind us of a Wanganui Chronicle article published over a year ago (28 July 2005 to be exact) titled, "No sneaky sale of gas utility, Laws promises".

In particular, our correspondent quotes the passages which say "Mr Laws said council had to find a way to deal with ballooning debt... Council had debts of around $25 million, which were projected to increase to $55 million by 2008-09..." and has Mickey saying "'That debt is largely a consequence of the new sewage treatment facilities and the wastewater separation project.'"

True enough. But then, as this Watcher so accurately, if rhetorically, enquires: "Based on this fact, how on earth can this 'Heart of Wanganui' project be pulled off? This is not good governance, and by no means financially [in] the best interest of Wanganui". Indeed.

Even if one unequivocally accepts that the proposals contained within the Heart of Wanganui plan are good for the city (and we're not, at this stage, saying they don't have the potential to be) it's still legitimate to ask, as our correspondent has, whether or not they are affordable for a city already faced with "ballooning debt".

So let'sadd a question of our own: Faced with the unavoidable debt mountain created by necessities such as sewers and wastewater, and trying to find a way to fund the grandiose schemes of its Fuhrer Mayor, how tempted will Council be to ask itself, even rhetorically, how much it might get if Wanganui Gas were put on the block?

Despite the Mayor's attack on the Chronicle for daring to suggest back in December 2005 that Wanganui Gas might be sold, Deputy Dotty managed to confirm that it was indeed a possibility in her River City Press column of 27 October that year:

While there have been reports on the value of the city and harbour endowment, and forestry, and recent debate on the figures for the airport, we can't recall any such report on Wanganui Gas.I note that there have been some letters to the newspapers recently about the potential sale of Wanganui Gas. Well, I would suggest that we do not panic as there are a myriad of options available that could ensure Wanganui ratepayers are gaining maximum value for their investment funds, and the outright sale of Wanganui Gas may not even be an option.

Wanganui District Council Holdings’ directors are researching the value of all of Wanganui’s investment assets and in due course there will be various reports on their findings. Such investments include harbour and city endowment land, the airport, forestry, the port and Wanganui Gas.

Whatever recommendations are made, these will be debated in council and wherever possible put out to consultation. Give the director’s (sic) a chance to get their feet under the assets table and suggest some options that might enhance our asset value (Our emphasis - Ed).

There's no doubting that the gas company represents a significant asset. Council's recent acquisition puts it in an ideal position to capitalise on not only the existing returns but also the company's significant potential. Of course there's the recent DHB contract and the lucrative supply contracts with commercial customers in Auckland. But Wanganui Gas is a big enough player to have looked at entering the Australian market (pdf link) in 2003 before later withdrawing (MS Word link).

Not only does that make it the jewel in the crown of Wanganui's asset base, but it also means it's a desirable takeover target if Council decided to divest it's shareholding - a task made much simpler now that it owns 100% - and might, by Mickey's own calculation, enrich Council's coffers by $20 million if they did so.

Mercury Energy has already sniffed around the company back in 2001 and there'd no doubt be many other interested buyers. All of whom would want "commercial confidentiality", of course. As with Council's purchase of Vector's shareholding, when Mickey explained "it’s one of those incredibly delicate confidential matters where we have to notify that we're having a meeting but we can't say too much about it."

Quite how such a process is reconciled with his promise that "there will be no sneaky sale" remains to be seen, if in fact such an event occurs. The anti-sneaky pledge was wrapped in talk of yet another referendum - presumably one with the same cast iron, no-wriggle-room sort of figures people were presented when asked to decide on the Splash Centre, or the "comparative costs" and "assumptions" connected with the Heart project.

We're not predicting the sale of the utility - at least not yet. If it happens, it's likely to come after Wanganui has referendumised itself into more debt by opting for an unaffordable "Heart" on top of an unaffordable "Splash". Then, when your assets are sold, you'll only have yourselves to blame.

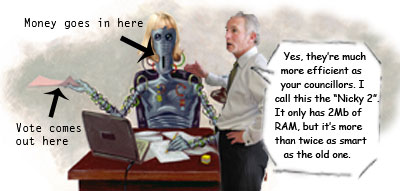

(Yes, we know the illustration bears no relation to the post topic. But with so much confusion in comments on the last post, we thought perhaps some readers needed a pictorial clarification of the facts).

Comments on this post are now closed.